Cash Flow Statement CFS Formula + Calculator

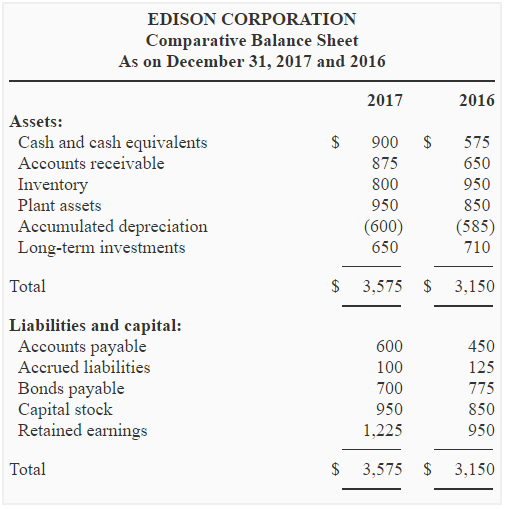

Dividends of $30,000 were paid to shareholders (found on the statement of retained earnings and the statement of owner’s equity). Finally, we see that Clear Lake must have issued additional common stock, as their common stock balance increased from $75,000 to $80,000. The following is a sample statement of cash flows that has been prepared based on the financial statements presented on page 255.

5: Using the Indirect Method to Prepare the Statement of Cash Flows

- For example, you can learn whether the company is generating enough cash from operations to cover its debts and other liabilities.

- For investors, the CFS reflects a company’s financial health, since typically the more cash that’s available for business operations, the better.

- If something has been paid off, then the difference in the value owed from one year to the next has to be subtracted from net income.

- These inflows and outflows are then calculated to arrive at the net cash flow.

- If a fixed asset’s balance increases from one year to the next, it means that more must have been purchased and there was a cash outflow.

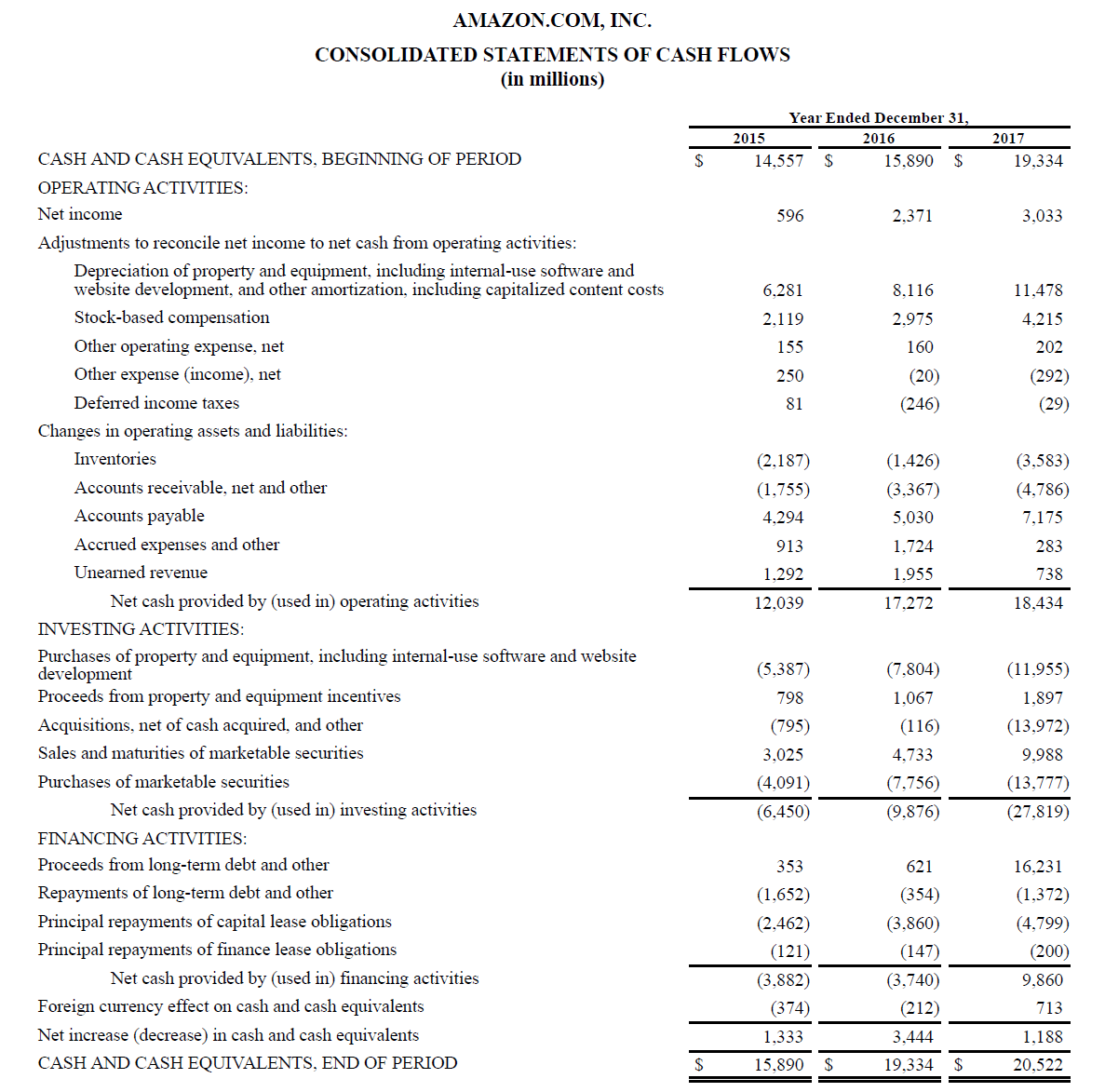

The direct method of calculating cash flow from operating activities is a straightforward process that involves taking all the cash collections from operations and subtracting all the cash disbursements from operations. This approach lists all the transactions that resulted in cash paid or received during the reporting period. Since cash flow statements provide insight into different areas a business used or received cash during a specific period, they’re important financial statements for valuing a company and understanding how it operates. Cash flow statements display the beginning and ending cash balances over a specific time period and points out where the changes came from (i.e operating activities, investing activities, and financing activities).

Direct Method

The terms of our capital structure include no material maintenance covenants, and there are no material debt maturities prior to May 2026. Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income the company earns happy tax day on the sales of its products and services. As a result, the business has a total of $126,475 in net cash flow at the end of the year. Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised.

Determine the Reporting Period

Understanding how to create, interpret, and effectively use financial statements is pivotal for strategic decision-making. Financial statements, particularly, are essential tools that extend beyond simple record-keeping that can guide your business strategy. Therefore, the cash flow statement is crucial for understanding the liquidity and operational efficiency of the business, which is vital for day-to-day operations and strategic planning. Cash flow is the total amount of cash that is flowing in and out of the company.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues. For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available.

This is because cash paid for these expenses was lower than the expenses recognized on the income statement using the accrual basis. Since expenses are $2,000 lower using the cash basis, net income must be increased by $2,000. However, how this information is presented depends on whether a company uses the “direct method” or “indirect method” for operating cash flows.

The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services. While each company will have its own unique line items, the general setup is usually the same. The beginning and ending balances that appear on the comparative balance sheet are the same as those in the Equipment ledger’s debit balance column on January 1 and September 12, respectively. The $10,000 credit entry is the cost of the equipment that was sold on April 3.

Calculating cash flow from operations by starting with net income and then adding/subtracting non-cash items is called the «indirect method.» This is how it is calculated for most publicly-traded companies. It implies that the company is not generating enough cash to sustain itself, let alone having cash left over to pay its debts. Below are explanations of the most common components of cash flow statements for publicly traded companies. By looking at the statement, you can see whether the company has enough cash flowing in to fund its operations, pay its debts, and return money to shareholders via dividends or stock buybacks.